Not At Fault Collision Claim

Average Rear End Collision Settlement Explained

Discover how we calculate your average rear end collision settlement and secure expert legal assistance.

Auto Collision Law Firm vs Individual Attorney

We show how our auto collision law firm vs individual attorney maximizes your compensation after a car crash.

Head On Collision Explained and When It Becomes a Legal Claim

Discover how we help you claim compensation for head on collision injuries, guiding you to the right lawyers.

Rear End Collision Attorney and Claim Eligibility

We guide injured accident victims to see if our rear end collision attorney can secure top compensation fast.

What To Do After a Rear End Collision Step by Step

We outline what to do after a rear end collision to document injuries and damage and pursue compensation.

Classic Collision Lawsuit and When Legal Action Applies

Discover classic collision lawsuit essentials, when to take legal action, and how we secure your compensation

What Does Collision Mean in Traffic Accidents

Discover what does collision mean, how we clarify your legal options and connect you with the right attorney.

Rear End Collision Claims and Typical Settlement Amounts

We help rear end collision victims get settlements with free case reviews and connect to the right attorney.

Collision Insurance vs Legal Claims Explained

We clarify what is the difference between comprehensive and collision insurance so you get full compensation

What To Do After a Car Collision to Protect Your Claim

Discover what to do after a car collision to secure our claim and connect with the right legal help

Car Collision Lawyer and When You Need Legal Help

We help accident victims with a car collision lawyer to secure maximum compensation and free case review.

Not At Fault Collision Claim and Your Right to Compensation

We help you file a not at fault collision claim to recover compensation and find the right attorney.

Head On Collision Lawyer and Legal Options After a Crash

We explain how a head on collision lawyer helps victims navigate claims and secure compensation after a crash

Types of Collisions and Legal Responsibility Explained

We detail types of collisions and liability so you know your claim eligibility and request a free case review

How Long Does a Rear End Collision Settlement Take

We reveal how long does a rear-end collision settlement take and share our steps to expedite your claim

Rear End Collision Settlement Examples and Timelines

We provide rear end collision settlement examples, timelines and legal steps to maximize your compensation.

Truck Collision Attorney for Serious Accident Claims

We guide accident victims to fair compensation with our expert truck collision attorney—free case evaluation.

What Is a Collision and When It Becomes a Legal Issue

Discover what is a collision, when it becomes a legal issue, and how we help you claim compensation.

Back Pain After a Rear End Collision and Legal Compensation

We explain how long does back pain last after a rear end collision and offer a free legal case review

A not at fault collision claim arises when you are involved in a car accident and the other driver is legally responsible for what happened. In these situations, you may have the right to seek compensation for property damage, medical expenses, lost income, and other costs that are directly related to the accident. Understanding how the claims process works is essential, especially when dealing with an insurance company that may not automatically agree with your version of events.

Get Legal Help

No Win, No Fee. Let the Best Collision Attorneys Fight for your Compensation!

Many people feel overwhelmed after an auto accident. There are police reports to obtain, vehicle repairs to schedule, insurance information to exchange, and medical bills to manage. In addition, questions often arise about whether you should contact your own insurance company or file a third party claim with the other driver’s insurance company. The situation can become stressful very quickly, particularly if fault is disputed.

This guide explains what a not at fault collision claim means, how fault is determined, how auto insurance typically works in most states, and what steps you should take to protect your rights. Whether you are dealing with minor vehicle damage or significant bodily injury, learning the basics can help you move forward with confidence.

What Does Collision Mean in Insurance Terms

In everyday language, a collision simply means that two vehicles hit each other. In insurance terms, collision refers to physical contact between your car and another vehicle or object. This could include a crash with another driver, a parked vehicle, or even a stationary object like a pole. The meaning becomes important when discussing car insurance coverage and how damages are paid.

Collision coverage is an add on to many auto insurance policies. It is intended to cover damages to your own vehicle after an accident, regardless of fault. If you are in a car accident and your car needs repairs, your insurer may pay for those repairs under your collision coverage, minus your deductible. Later, your insurer may seek reimbursement from the at fault driver’s insurance company through a process known as subrogation.

Understanding the collision meaning helps clarify what happens in a not at fault collision claim. If you were not at fault, you may have the option to file directly with the other driver’s insurance company. However, using your own insurance company may allow repairs to begin more quickly. Each option has advantages depending on your situation, your policy limits, and the state where the accident occurred.

What Is a Not At Fault Collision Claim

A not at fault collision claim is an insurance claim filed after a car accident in which you are not considered legally responsible. In this scenario, the at fault driver is expected to cover damages through their auto insurance. This typically includes property damage, medical expenses, and other losses directly related to the crash.

When an accident occurs, fault must be determined through investigation. Police reports, witness statements, photos, and physical evidence at the accident scene all play a role. Once fault is established, the at fault driver’s insurance company is generally responsible for paying covered damages up to the policy limits.

In some situations, you may initially use your own insurance company to handle vehicle repairs and then allow your insurer to recover costs from the other driver’s insurance company. This can help you avoid delay, especially if the other insurer is slow to respond. However, you may have to pay your deductible upfront, which could later be reimbursed.

It is important to understand that being not at fault does not automatically guarantee payment. The claims process still requires documentation, evidence, and cooperation. Insurance companies investigate each claim to determine liability and coverage before issuing payment.

Your First Priority After a Car Accident

After any car accident, your first priority is safety. Check yourself and any other person involved for injuries. If anyone appears hurt, call emergency services immediately. Even if you feel safe and believe the accident was minor, it is important to assess the situation carefully.

Move your vehicle to a safe location if possible and turn on hazard lights. Protecting yourself and others from further harm should always come before dealing with insurance matters. Once safety is addressed, you can begin gathering as much information as possible about the accident.

Exchange information with the other driver, including names, contact details, insurance information, and policy number. Collect the license plate number and take pictures of the accident scene. Photos of vehicle damage, road conditions, traffic signs, and any visible injuries can become important evidence during the investigation.

Remember that what you say at the scene can affect your claim. Avoid admitting fault or agreeing to any statements about responsibility. Simply exchange information and allow the investigation to determine who was at fault.

Get Legal Help

No Win, No Fee. Let the Best Collision Attorneys Fight for your Compensation!

How Fault Is Determined

Fault in a car accident is not based solely on opinion. It is determined through a careful investigation that considers multiple factors. Insurance companies, police officers, and sometimes courts review evidence to decide which driver is legally responsible.

A police report often plays a central role in establishing fault. The report may include the officer’s observations, statements from the parties involved, and details about traffic violations. Witnesses can provide additional information that supports one version of events over another.

Comparative negligence laws in most states allow for shared fault. If you are found partially responsible, your compensation may be reduced by a percentage that reflects your share of fault. For example, if you are determined to be 20 percent at fault, your recovery may be reduced by that amount.

In no fault states, the process works differently. Drivers typically file with their own insurance company for medical expenses, regardless of fault. However, property damage claims may still involve the at fault driver’s insurance. Understanding your state’s laws is essential because they directly affect how your claim is handled.

Filing With the Other Driver’s Insurance Company

When you are not at fault, one option is to file a third party claim directly with the other driver’s insurance company. This approach seeks payment from the at fault driver’s insurer without involving your own coverage.

The advantage of a third party claim is that you may avoid paying your deductible. The other driver’s insurance company is expected to cover damages up to their policy limits. This may include vehicle repairs, rental car costs, medical bills, and other expenses.

However, dealing with the other driver’s insurance company can be slow. They will conduct their own investigation and may request documentation, statements, and evidence before agreeing to pay. If there is any dispute about fault, the process can take time.

You should collect and submit as much information as possible, including photos, medical records, repair estimates, and a copy of the police report. Providing thorough documentation can help move the claims process forward more quickly.

Filing With Your Own Insurance Company

Another option is to file a claim with your own insurance company, even if you were not at fault. If you carry collision coverage, your insurer can pay for vehicle repairs and then seek reimbursement from the other driver’s insurance company.

This method can reduce delay because your own insurer has a contractual relationship with you. They may process repairs more quickly and assist with arranging a rental car. However, you may be required to pay your deductible upfront.

Your insurer will investigate the accident and determine whether to pursue subrogation against the at fault driver’s insurance. If successful, you may receive reimbursement for your deductible.

Using your own insurance company does not automatically increase your premiums, but it can affect your policy depending on your insurer’s practices and state regulations. Always review your insurance policy and discuss your options before deciding how to proceed.

What Damages Can Be Covered

In a not at fault collision claim, several types of damages may be covered. Property damage includes vehicle damage and the cost of repairs. If your car is totaled, you may receive payment based on its market value.

Medical expenses are another major category. These may include emergency care, follow up treatment, therapy, and medical bills directly related to bodily injury from the accident. Keeping detailed records is critical to ensure proper reimbursement.

Additionally, you may seek compensation for lost wages if injuries prevent you from working. Rental car costs and other expenses related to transportation may also be covered.

In some cases, damages include pain and suffering, though these are more common in serious injury claims and may require legal assistance to pursue.

Other claims you can recover damage from:

Dealing With Insurance Adjusters

Insurance adjusters represent the insurance company, not you. Their role is to investigate claims and determine what the insurer will pay. While many adjusters act professionally, their objective is to manage company costs.

You may be asked to provide statements or documentation. Always review forms carefully before signing and avoid agreeing to anything without understanding the terms. If you are unsure, consult a personal injury attorney before proceeding.

Be patient but proactive. Follow up regularly, keep copies of all documents, and document every conversation, including the date, time, and name of the person you spoke with. Organized documentation can protect you if disputes arise.

When Legal Assistance May Be Necessary

While many not at fault collision claims are resolved without legal action, certain situations require professional guidance. If fault is disputed, injuries are significant, or the insurer refuses to pay fair compensation, consulting an experienced personal injury attorney can make a difference.

A personal injury lawyer can review your case, assess liability, and help you navigate the legal process. They can also assist in gathering evidence, communicating with insurers, and filing a lawsuit if necessary.

Most personal injury attorneys offer a free consultation. If you are facing substantial damages or feel overwhelmed, seeking legal advice can provide clarity and protection.

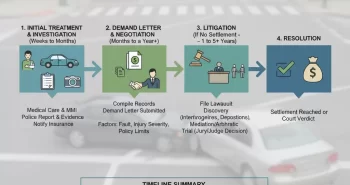

The Claims Process Timeline

The claims process can vary widely depending on the complexity of the accident. Simple property damage claims may be resolved in weeks, while cases involving bodily injury can take months or years.

Prompt reporting, complete documentation, and cooperation can help avoid unnecessary delay. However, investigations sometimes move slowly, especially when multiple parties are involved.

Stay organized and maintain communication with your insurer. Respond to requests quickly and keep copies of everything you submit. Patience and persistence are often required to reach a fair resolution.

Final Thoughts on Not At Fault Collision Claims

A not at fault collision claim is designed to help you recover after a car accident caused by another driver. Understanding how fault is determined, how insurance works, and what damages may be covered empowers you to make informed decisions.

The situation can feel overwhelming, but taking the right steps from the beginning protects your interests. Focus on safety, gather evidence, notify the appropriate insurance company, and keep detailed records.

If complications arise, legal assistance may help ensure that your rights are protected. By learning how the system works and preparing carefully, you can move through the claims process with greater confidence and clarity.

Get Legal Help

No Win, No Fee. Let the Best Collision Attorneys Fight for your Compensation!