Rideshare Accident Injury Claims

When Do You Need a Rideshare Accident Lawyer?

When do we need a rideshare accident lawyer? We guide you to secure compensation after an Uber or Lyft crash.

When Does an Uber Accident Lawsuit Make Sense?

We explain when an uber accident lawsuit makes sense, how to recover damages, and secure a free case review.

When Can You File a Lyft Accident Lawsuit?

We outline when to file a Lyft accident lawsuit, your eligibility, key steps and a free case review.

What to Do If Your Uber Crashes Step by Step

We guide you through what to do if your Uber crashes, protecting your claim and securing legal support.

How Uber Accident Settlements Are Calculated

We explain uber accident settlement calculations, outlining factors, injuries, liability, and legal options.

Is Uber Liable for Accidents Involving Their Drivers?

Is Uber liable for accidents? Discover how we pursue your compensation and navigate liability rules.

How a Rideshare Accident Attorney Can Help After an Uber or Lyft Crash

We connect crash victims with the right rideshare accident attorney after an Uber or Lyft crash.

How to Choose the Right Rideshare Accident Law Firm

We help you choose the right rideshare accident law firm for max compensation after an Uber or Lyft accident.

I Was a Passenger in an Uber Accident What Are My Rights?

I was a passenger in an Uber accident? We explain our rights, insurance coverage, and compensation options.

When Should You Contact an Uber Rideshare Accident Lawyer?

Learn when we should contact an Uber rideshare accident lawyer to protect our rights and secure compensation.

Rideshare Accident Lawsuits Explained

We guide you step by step through a rideshare accident lawsuit to secure the compensation you deserve.

How a Lyft Rideshare Accident Attorney Can Help You

We connect you with a leading Lyft rideshare accident attorney to secure compensation and a free case review.

Can I Sue Uber for an Accident?

Can I sue Uber for an accident? We clarify your rights, compensation options and offer a free case review.

Hit by an Uber Driver Who Is Responsible?

Hit by an Uber driver? Our guide helps us prove liability, navigate insurance, and secure compensation

What Happens in a Rideshare Car Accident?

We guide rideshare car accident victims through liability, insurance, and compensation with expert legal help

How Uber Accident Claims Work and What You Can Recover

We guide you through uber accident claims to maximize your compensation and connect you with the right lawyer

Injured in an Uber Accident What Should You Do Next?

Injured in an Uber accident? We outline our steps for safety, evidence, insurance claims and legal action.

Rideshare accident cases feel like normal car accident cases until you try to file. Uber and Lyft use layered insurance coverage, drivers are independent contractors, and multiple insurance companies can get involved fast. That changes the claims process, the liability determination, and the way insurance adjusters handle an injured passenger.

Get Legal Help

No Win, No Fee. Let the Best Rideshare Accident Attorneys Fight for your Compensation!

If an accident occurred in a rideshare vehicle, your first step is always safety. Get immediate medical attention, then report the accident, then protect your legal rights. After that, you focus on evidence, trip details, and determining liability. This is how you move toward fair compensation, without relying solely on an insurance company that may try to minimize payouts.

This guide explains rideshare insurance coverage, how much coverage may apply, and how to pursue claims when rideshare passengers injured face medical bills, lost wages, physical pain, and emotional distress.

How Rideshare Accident Claims Differ From Standard Car Accident Claims

Rideshare services create unique challenges because insurance applies based on driver’s status in the rideshare app. That status is not a small detail. It decides whether personal auto insurance applies, whether the rideshare company’s insurance applies, and whether you must file a third party claim against the at fault driver.

With most personal auto policies, a driver’s personal insurance is built for personal use. Many personal policies do not cover commercial activity. That is why rideshare companies add rideshare insurance coverage that can apply when the driver is logged into the app, waiting for a ride request, en route to pick someone up, or actively transporting rideshare passengers.

This structure creates multiple insurance policies and multiple insurers in one file. You can have a driver’s personal policy, the at fault driver’s insurance, and the rideshare company’s policy all arguing coverage limits and fault. Corporate legal teams can also influence how quickly the case moves, especially in serious injuries and severe injuries cases. That is why rideshare accident taking early steps seriously matters.

Step One At the Accident Scene, Safety Medical Attention And Documentation

Start with safety at the accident scene. Check yourself and rideshare passengers for visible injuries, then call police. If you can move to a safer location, do it. Motor vehicle crashes can cause delayed symptoms, especially head injuries, herniated discs, and internal injuries that do not look urgent at first.

Seek medical attention the same day. Immediate medical attention protects your health, and it creates medical records that connect injuries to the accident caused by another driver or a driving negligently rideshare driver. Keep every document. Save discharge papers, imaging notes, physical therapy referrals, and follow up plans. Those become critical evidence in injury claims and personal injury claims.

Ask for a police report number before you leave. Police reports matter more in rideshare accident cases because rideshare liability can involve multiple parties and disputed trip details. Take photos of vehicles involved, the rideshare vehicle interior if relevant, road conditions, traffic signs, and any property damage. If there are witnesses, get witness statements and contact details. If traffic cameras or nearby cameras exist, note locations. A thorough investigation starts with what you collect in the first hour.

Rideshare App Status Controls Which Insurance Coverage Applies

Rideshare insurance coverage changes based on whether the uber or lyft driver was logged into the app, whether the driver accepts a ride request, and whether the driver was actively transporting. This is the core reason rideshare accident cases become complicated.

There are usually three practical phases.

First phase, app off. The driver is not actively working. The driver’s personal auto insurance and the personal auto policy are usually the main coverage. If the accident involving the rideshare vehicle happens here, the rideshare company’s insurance may not apply.

Second phase, logged into the app and waiting. The rideshare driver is available but has not yet accepted a ride request. Some rideshare companies provide limited coverage here. People often describe this layer as a smaller liability coverage amount, sometimes referenced as 50,000 per person for bodily injury in certain circumstances. Treat that as an example, not a promise. Coverage limits vary by state and policy.

Third phase, driver accepts and then active ride. Once the driver accepts, and especially when actively transporting rideshare passengers, commercial coverage may apply through the rideshare company’s policy. This phase is where the larger rideshare company’s insurance often becomes central.

To prove driver’s status, save trip details from the uber app or Lyft app. Screenshot the ride route, timestamps, and driver information. That evidence helps determine which insurance applies.

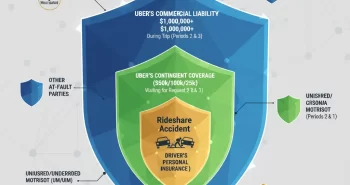

Key Insurance Policies In Uber And Lyft Accident Claims

Rideshare accident cases often involve multiple insurance policies. You need to understand what each policy is trying to do, and why multiple insurers may point fingers.

Driver’s personal insurance and driver’s personal auto insurance. This is the starting point when the rideshare app is off, and it can still matter in other phases if gaps appear. Many personal policies have exclusions for commercial activity. That can trigger disputes.

Rideshare company’s insurance and rideshare company’s policy. This is the coverage tied to uber and lyft operations. It can include liability insurance, uninsured coverage in some situations, and commercial coverage when the driver is actively working.

At fault driver’s insurance and at fault driver’s insurance company. If another driver caused the crash, you may pursue claims against the at fault driver directly as a third party claim. That can run alongside a rideshare insurance claim.

Your own insurance company and personal insurance. Your personal auto insurance can matter for medical attention bills, underinsured scenarios, or when you need quick help with property damage. This depends on your insurance policy terms and the state legal landscape.

Because multiple insurance companies may be involved, you must keep every claim number, adjuster name, and communication log. Organization becomes leverage.

Determining Liability In A Rideshare Accident

Determining liability is harder in rideshare accident cases because the parties involved can include the uber driver, another driver, a third party liability issue like a vehicle defect, and sometimes road conditions or unsafe design. Liability determination is not only about who hit who. It is also about negligence, drivers actions, and whether the at fault driver violated a duty of care.

Common fault patterns include distracted driving, reckless driving, speeding, unsafe lane changes, and failure to yield. If the rideshare driver caused the crash while actively working, you still have to prove fault. The rideshare companies often argue the driver is an independent contractor, not an employee. That is why you see terms like drivers are independent contractors and independent contractors in rideshare legal process discussions.

Vicarious liability is when a company is held vicariously liable for employees actions. With rideshare companies, that argument can be complex. Some claims focus on company responsibility through insurance structure rather than direct employment. That is why you may see legal counsel frame issues as rideshare liability rather than simple employer liability.

Your goal is to identify liable parties and responsible parties, then match them toS=to coverage that actually pays.

What To Say And What To Avoid Saying To Insurance Adjusters

Insurance adjusters are trained to collect statements that reduce payout value. In rideshare accident cases, this pressure can come from multiple insurers, including the driver’s insurance, the rideshare company’s insurance, and the other driver’s insurance company.

Avoid giving recorded statements early. Do not agree to a recorded statement while you are in pain, stressed, or unsure about injuries. If you must speak, keep it factual. Confirm the date, time, location, and that you are seeking medical attention. Do not guess speed. Do not assign fault. Do not minimize symptoms by saying you feel fine. Do not say your injuries are minor until medical records confirm the full picture.

If you have legal representation, route calls through your attorney. This is not about hiding facts. It is about protecting accuracy and preventing misinterpretation. Recorded statements can be used to shift blame, claim share fault, or argue injuries came from something else.

Ask insurers to communicate in writing when possible. Save emails and letters. In complicated claims process situations, documentation can be the difference between a quick settlement that is too low, and a fair settlement that reflects medical expenses, lost wages, and non economic damages.

The Claims Process Step By Step For Rideshare Injury Claims

Rideshare injury claims follow a pattern, but the presence of multiple insurance companies changes the timing and the strategy. A clean process helps you pursue compensation without missing time limits.

- Step 1, report the accident. Use the rideshare app, and call police. Get the police report.

- Step 2, get medical attention. Even visible injuries can hide deeper damage. Keep medical records and itemized medical bills.

- Step 3, collect evidence. Photos, witness statements, trip details, and the list of vehicles involved. Note nearby businesses and traffic cameras.

- Step 4, confirm driver’s status. Was the driver logged into the app, waiting, en route, or actively transporting. This controls coverage applies decisions.

- Step 5, open insurance claims. You may file a claim with the rideshare company’s insurance, the at fault driver’s insurance, and sometimes your own insurance company.

- Step 6, liability determination and damages. Insurers investigate, then negotiate. This is where they try to minimize payouts.

- Step 7, settlement or legal action. If negotiations fail, you may consider a personal injury lawsuit. That step depends on serious injuries, disputed fault, and whether maximum compensation requires legal process escalation.

Common Injuries And How They Shape Potential Compensation

In rideshare accident cases, injuries range from soft tissue strains to broken bones, head injuries, and herniated discs. Serious injuries often trigger higher medical expenses and longer recovery timelines, which changes the settlement value and the leverage in insurance negotiations.

Medical costs matter, but so does function. If you cannot work, lost wages and missed work documentation becomes a core part of fair compensation. If you need ongoing care, add projected treatment costs and future medical needs into the claim. Keep every medical record, prescription, and physical therapy plan. This is the easiest way to prove impact.

Non economic damages cover pain and suffering, emotional distress, and disruption of life. Some accident victims deal with sleep issues, anxiety in traffic, and fear of riding again. Those symptoms still matter, but you must document them with care. A journal and consistent medical attention help. If you stop treatment, insurers may argue you recovered.

Property damage also counts. If you lost personal items in the crash, document replacement value. If you were another motorist hit by a rideshare vehicle, vehicle damage and repair evidence becomes central.

How Much Coverage Applies In Uber And Lyft Accident Claims

People search how much coverage because rideshare insurance is confusing by design. The accurate answer is, it depends on driver’s status, state rules, and policy wording. Still, you can understand the structure and avoid mistakes.

When the driver is not logged into the app, the driver’s personal policy usually applies. When logged into the app but not on an active ride, coverage can be limited coverage. This is the phase where people reference figures like 50,000 per person for bodily injury as a common example of a lower layer. The real number depends on jurisdiction and the rideshare company’s policy at the time.

When the driver accepts and is en route or actively transporting rideshare passengers, commercial coverage often expands. That can include higher liability coverage, and it can change how quickly insurers take the claim seriously. Coverage limits still matter. Policy limits can cap what you recover even with severe injuries.

Because multiple insurers may overlap, insurers may argue which policy is first line. That is why you should not rely solely on the first adjuster’s explanation. Ask for written confirmation of what insurance applies and why.

Uber Accident Claim And Lyft Accident Claim, What You Must Prove

An uber accident claim or a lyft accident claim usually requires you to prove four key elements.

First, the accident occurred and you were involved. Trip details and the rideshare app record can confirm this.

Second, the at fault driver or rideshare driver acted negligently. That can be distracted driving, reckless driving, or failing to follow road rules. You support this with police report findings, witness statements, crash scene photos, and sometimes traffic cameras.

Third, you suffered injuries and financial harm. Medical records, medical bills, and wage proof establish medical expenses and lost wages.

Fourth, the injuries connect to the crash. This is why immediate medical attention matters. A gap gives insurers room to argue the accident did not cause the injury.

Rideshare companies also raise unique challenges around driver’s status and independent contractors arguments. That is why rideshare liability is often disputed even when fault looks clear. Strong evidence and a consistent treatment record create a strong case that stands up during liability determination and settlement negotiations.

Get A Rideshare Attorney

No Win, No Fee. Let the Best Rideshare Accident Attorneys Fight for your Compensation!

Rideshare Passengers Injured, Rights Options And Best Interest Steps

If you are a passenger, you often have a clean path to seek compensation because you did not cause the crash. Still, you can face disputes between multiple insurance companies about who pays first. You can also face pressure for a quick settlement that fails to cover full compensation.

Your best interest is to protect documentation. Save the ride receipt, route map, and driver name. Take photos at the scene if you can. Ask for the police report. Seek medical attention, even if you feel fine.

If you are hurt, you can pursue claims for medical expenses, lost wages, and non economic damages like emotional distress. If injuries are severe injuries, add ongoing treatment projections. If you had out of pocket costs like transportation, medication, or device replacement, keep receipts.

Do not sign releases early. Insurers may try to close the file before the full scope of injuries is known. A fair settlement should reflect recovery time, missed work, and long term impacts.

If you need help, a free consultation with an accident attorney can clarify what insurance coverage applies and which liable parties you should target.

Rideshare Drivers And Insurance, Personal Policies And Corporate Coverage Conflicts

If you are a rideshare driver, the insurance questions get more complicated. Your driver’s personal auto insurance and personal auto policy may not cover you if the insurer claims commercial use. That can lead to denied coverage disputes. Rideshare insurance coverage can fill the gap, but only if your driver’s status is documented.

You should report the accident inside the rideshare app, and keep trip details. Confirm whether you were waiting, en route, or actively transporting. This impacts whether the rideshare company’s insurance applies and whether commercial coverage steps in.

Drivers also face third party liability claims from other road users, pedestrians, and other motorists. If the accident caused injuries to others, bodily injury claims can arise quickly. If you were not at fault, you may still need to pursue claims against the at fault driver’s insurance.

Because corporate legal teams and multiple insurers may pressure you, legal representation can help you keep the story consistent and evidence based. You also protect your income by keeping wage records, ride logs, and time away from work documented.

Other claims you can recover damage from:

When Legal Representation Matters, Free Consultation And Contingency Fee Basis

Not every rideshare accident needs a lawyer, but many do. The moment you see serious injuries, severe injuries, disputed fault, or multiple insurance companies arguing coverage limits, legal counsel becomes practical, not optional.

An experienced attorney can manage the claims process, push liability determination forward, and handle corporate legal teams. They also help you avoid giving recorded statements that can be used to minimize payouts. If negotiations fail, they can prepare for legal action and a personal injury lawsuit.

Most people worry about cost. Many personal injury attorneys offer a free consultation and work on a contingency fee basis. That means the fee is tied to recovery, not upfront billing. Ask direct questions about fees, case management, and communication.

A lawyer also helps build a strong case with a thorough investigation. That can include obtaining phone records when distracted driving is suspected, pulling traffic camera footage, and organizing medical records into a clear damages narrative. Legal guidance can be the difference between a quick settlement and compensation you deserve that reflects real harm.

Fair Settlement And Full Compensation, How Insurers Try To Minimize Payouts

Insurance company tactics in rideshare accident cases often look the same across carriers. They move fast to lock you into statements. They offer quick settlement checks before you understand the full cost. They challenge treatment. They argue share fault. They question whether the accident caused the injury.

To protect yourself, document everything. Keep medical records, bills, and treatment appointments. Track missed work and wages. Save receipts for medication and transportation. Keep photos of bruising and visible injuries that change over time.

When you negotiate, focus on facts. Medical expenses, lost wages, and documented pain levels matter. If you have emotional distress, connect it to medical attention and treatment notes. This makes non economic damages harder to dismiss.

Insurers also use coverage limits as a cap. Even when liability is clear, policy limits can restrict payout. That is why identifying multiple liable parties and multiple insurance policies can increase available financial compensation.

A fair settlement is not a feeling. It is a number backed by evidence, medical documentation, and realistic future care needs.

Final Checklist, What To Do Next After A Rideshare Accident

If you want the cleanest path toward fair compensation, follow this checklist.

- First step. Get to safety, then get medical attention. Do not assume you are fine.

- Second. Call police and get the police report.

- Third. Collect evidence at the crash scene. Photos, vehicles involved, road conditions, trip details, witness statements, and nearby businesses.

- Fourth. Report the accident inside the uber app or Lyft app. Save screenshots.

- Fifth. Do not give recorded statements. Avoid giving recorded statements until you understand injuries and coverage.

- Sixth. Open insurance claims with the right carriers. This can include the rideshare company’s insurance, the at fault driver’s insurance, and your own insurance company.

- Seventh. Track medical bills, lost wages, and property damage. Keep a simple folder.

- Eighth. If you face serious injuries, disputed fault, or multiple insurers, get legal representation. A free consultation can clarify your legal rights, time limits, and the best path through the legal process.

Get Legal Help

No Win, No Fee. Let the Best Rideshare Accident Attorneys Fight for your Compensation!