Road Traffic Accident Claims

Can You Claim Whiplash After A Motor Vehicle Accident

See if you’re owed compensation for a whiplash motor vehicle accident and get a free case review.

Can You File A Motor Vehicle Accident Claim If You Already Have A Lawyer

Can you file a motor vehicle accident already represented claim? Discover your eligibility and next steps.

Why Do Motor Vehicle Accident Claims Without Injuries Get Rejected

See why your motor vehicle accident without injury claim gets denied and how docs and legal help protect you.

Can You File A Motor Vehicle Accident Claim With Uninsured Motorist Coverage

Can you file an uninsured motorist motor vehicle accident claim? Learn if you qualify and get a case review.

Do You Still Qualify If Your Motor Vehicle Accident Happened Within The Last 12 Months

Find out if you qualify for a 12-month crash claim and the motor vehicle accident statute of limitations.

Can You File A Motor Vehicle Accident Claim Without A Police Report

Don’t have a motor vehicle accident police report? Learn how to file your claim and secure your compensation.

Is A Motor Vehicle Accident Lawsuit Better Than An Insurance Claim

Is a motor vehicle accident lawsuit better than an insurance claim? Learn how to maximize your compensation

Can You Get Compensation If You Were A Passenger In A Motor Vehicle Accident

Wondering if you can claim compensation after a passenger motor vehicle accident? Learn your rights and next steps.

What Legal Options Do You Have After A Serious Motor Vehicle Accident

Get motor vehicle accident legal advice now to claim the compensation you deserve after a serious crash.

Does Medical Treatment Within Two Weeks Matter After A Motor Vehicle Accident

Find out why motor vehicle accident medical treatment within two weeks matters for your compensation claim.

How Long Does A Motor Vehicle Accident Settlement Take

Discover your motor vehicle accident settlement amounts and timeline with a free case review.

Which Motor Vehicle Accident Injuries Require Ongoing Treatment

Learn which motor vehicle accident injuries may need ongoing treatment and how to claim care & compensation.

Can Passengers Get Motor Vehicle Accident Compensation

Find out how you can get motor vehicle accident compensation as a passenger and get a free legal case review

How Does Motor Vehicle Accident Compensation Work

Discover how motor vehicle accident compensation works and maximize your benefits with a free LCA case review

Does Motor Vehicle Accident Prevention Affect Legal Claims

Discover how motor vehicle accident prevention can strengthen your legal claim and get a free case review.

Were You Injured In A Motor Vehicle Accident And Not At Fault

Injured in a motor vehicle accident not at fault? See if you qualify for compensation and free case review.

Can You Get Compensation In A No Fault Motor Vehicle Accident

Find out if you qualify for compensation in a no fault motor vehicle accident and get a free case review

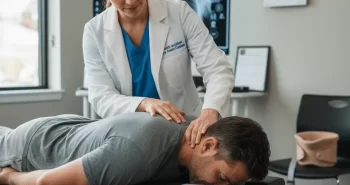

Does Seeing A Motor Vehicle Accident Chiropractor Help Your Claim

Find out how a motor vehicle accident chiropractor can boost your injury claim and secure compensation.

What Are Motor Vehicle Accident ICD 10 Codes Used For

Learn how motor vehicle accident ICD 10 codes help you document injuries, track care and support your claim.

Can A Motor Vehicle Accident Compensation Calculator Be Trusted

Wondering if a motor vehicle accident compensation calculator is accurate? Discover how to protect your claim

Can You File A Claim After A Pedestrian Motor Vehicle Accident

Hurt in a pedestrian motor vehicle accident? Find out how to file your claim and get a free case review now.

Who Is At Fault In A T Bone Motor Vehicle Accident

Injured in a t bone motor vehicle accident? Discover who’s at fault and how to claim your compensation today.

What Medical Records Matter Most In A Motor Vehicle Accident Claim

Learn which motor vehicle accident medical records support your injury claim and boost your compensation

Do Photos And Witness Statements Help A Motor Vehicle Accident Claim

Discover how photos and witness statements boost your motor vehicle accident evidence to win compensation.

Which Motor Vehicle Accident Injuries Usually Qualify For Compensation

Find out if your motor vehicle accident injuries qualify you for compensation and get a free case review.

What Happens If You Were Not At Fault In A Motor Vehicle Accident

Discover your rights after a not at fault motor vehicle accident and secure free legal help for compensation

When Is A Motor Vehicle Accident Expert Witness Needed

Unsure if you need a motor vehicle accident expert witness? Discover how testimony can power your claim.

Does A Motor Vehicle Accident Prevention Course Affect Your Case

See how a motor vehicle accident prevention course can strengthen your claim and maximize your compensation.

What Does Motor Vehicle Accident Law Mean For Injury Victims

Learn how motor vehicle accident law protects you, aids compensation, and connects you with expert help.

Who Can File A Wrongful Death Claim After A Motor Vehicle Accident

Find out if you can file a wrongful death from motor vehicle accident claim with free case review.

What Is The Statute Of Limitations For A Motor Vehicle Accident

Time’s ticking: know the statute of limitations for a motor vehicle accident and claim compensation.

How Do You Choose A Motor Vehicle Accident Law Firm Near Me

Injured in a wreck? Find the best motor vehicle accident law firm near me for your free case review now.

Where Can You Get Motor Vehicle Accident Legal Advice

Get motor vehicle accident legal advice to protect your rights, boost compensation, get a free case review.

Does Motor Vehicle Accident Physiotherapy Count As Medical Treatment

See how motor vehicle accident physiotherapy qualifies as medical treatment to strengthen your injury claim.

Why Is A Motor Vehicle Accident Report Important For Your Claim

Find out why your motor vehicle accident report is vital for your claim and how to secure top compensation.

When Do You Need A Motor Vehicle Accident Attorney

Need a motor vehicle accident attorney? Get your free case review now and explore your compensation options.

When Should You File A Motor Vehicle Accident Lawsuit

When should you file your motor vehicle accident lawsuit? Check your eligibility and get a free case review.

What Do You Need For A Motor Vehicle Accident Injury Claim

Discover what you need for a motor vehicle accident injury claim and get expert tips to boost your payout.

How Do Motor Vehicle Accident Claims Work For Non Fault Drivers

Non-fault driver? Find out how motor vehicle accident claims work and secure your compensation today.

What Should You Do After A Motor Vehicle Accident

Find out what to do after a motor vehicle accident to protect your claim, get care, and find legal help.

What Is A Motor Vehicle Accident And When Do You Qualify For Compensation

Learn what is a motor vehicle accident and how you can qualify for compensation with a free case review.

Do You Need Motor Vehicle Accident Lawyers To File A Claim

Not at fault? Motor vehicle accident lawyers can boost your claim and give you a free case review.

How Much Are Motor Vehicle Accident Settlement Amounts

See what motor vehicle accident settlement amounts you’re entitled to and get your free case review.

Can A Motor Vehicle Accident Head Injury Lead To Compensation

Wondering if your motor vehicle accident head injury qualifies for compensation? Get free case review now.

Can You File Motor Vehicle Accident Claims If The Other Driver Is Uninsured

Struck by an uninsured driver? Learn how to file motor vehicle accident claims and get paid fast.

A road traffic accident claim is a legal way to seek compensation after you are involved in a car accident or other motor vehicle accident caused by another party. If you are an injured person, suffered vehicle damage, or experienced financial losses because of a road accident, you may be entitled to fair compensation through an insurance claim or personal injury claim.

Get Legal Help

No Win, No Fee. Let the Best Road Traffic Accident Attorneys Fight for your Compensation!

This type of accident claim applies to drivers, passengers, pedestrians, and families dealing with wrongful death. Compensation may cover medical expenses, repair costs, property damage, lost income, and other medical costs that result from the accident. Whether the incident involved two vehicles, multiple vehicles involved, or other motorists, the claims process starts by establishing fault and legal liability.

If you were involved in a car crash and the other driver was at fault, filing a road traffic accident claim can make all the difference in recovering damages and protecting your financial future.

What Is a Road Traffic Accident Claim and When Can You File One?

A road traffic accident claim is filed when a person suffers injuries, vehicle damage, or other losses due to a road accident caused by another party. This includes car accidents, auto accidents, and collisions involving passenger vehicles or other motor vehicles.

You can usually file a car accident claim if:

- You were not the at fault driver

- You injuries suffered or medical bills

- Your vehicle sustained damage

- You experienced financial losses

Claims can be filed by car accident victims, passengers, pedestrians, or surviving family members in wrongful death cases. In most situations, the claim is filed against the other driver’s insurance provider. In some cases, you may also need to file a car insurance claim with your own driver’s insurance company, depending on your insurance coverage and insurance policy.

An experienced car accident attorney or experienced car accident lawyer can help determine whether you have a valid auto accident claim and guide you through the claims process.

Your First Priority After a Car Accident

After a car accident, your first priority is always safety. What you do in the minutes and hours after the accident can affect your health, your insurance claim, and your ability to seek compensation.

Safety and Medical Treatment

Immediately check yourself and others involved in a car for injuries. Turn on hazard lights, move to a safe location if possible, and call emergency services if anyone is hurt. Even if injuries seem minor, seek medical treatment as soon as possible. Some injuries do not appear right away but can lead to serious medical costs later.

Early medical treatment creates medical records that connect your injuries to the accident. These medical records are critical when filing a personal injury claim or car insurance claim. Delaying care can give an insurance company a reason to question your injuries or reduce compensation.

What to Do at the Accident Scene

Once safety is addressed, focus on gathering key information at the accident scene. Call the police so an officer can document the incident and create a police report. Ask for the officer’s name and badge number or name and badge number for your records.

Exchange information with all people involved, including:

- Names and contact info

- Insurance information and insurance provider

- License plate numbers and vehicle registration

- Details of all vehicles involved

Take photos of vehicle damage, other vehicles, stop signs, road conditions, and the accident scene. Do not admit fault for the accident or answer basic questions beyond providing factual information. Fault and legal liability should be determined later through the claims process.

These same steps apply whether the accident involved another car, multiple parties involved, or other motorists. Proper documentation helps insurance covers the damage fairly and supports your ability to recover damages.

Car Insurance Coverage That May Apply

After a road traffic accident, understanding which car insurance coverage applies is essential before you file a claim. Insurance coverage determines who pays for vehicle damage, medical expenses, and other losses. The type of coverage involved depends on who caused the accident, the policies held by the drivers, and the circumstances of the crash.

In many cases, multiple insurance policies may apply at the same time. This can include the other driver’s insurance, your own policy, and specific coverages like collision coverage. Knowing how these layers work helps you avoid delays and puts you in a stronger position when seeking compensation.

Car Insurance and Collision Coverage

Car insurance is designed to cover financial losses after an accident, but not all policies work the same way. Collision coverage typically pays to have your vehicle repaired or replaced after a crash, regardless of who was at fault. This coverage can help you get your vehicle repaired quickly and save money upfront, especially when fault is disputed.

In some states, Personal Injury Protection coverage may also apply. PIP can help cover medical expenses and lost income, even before fault is fully determined. However, claims often exceed coverage limits when injuries are serious or long term.

If damages go beyond available coverage, you may need to file a claim against other parties involved or seek legal help to recover the remaining losses. Exchanging contact and insurance details with all other parties at the scene is critical to protect your claim.

What Compensation Can You Recover in a Road Traffic Accident Claim?

A road traffic accident claim is meant to compensate you for the full impact of the accident, not just immediate repair costs. Compensation can include both financial losses and the personal consequences of injuries.

The value of a claim depends on the severity of injuries, medical treatment required, and how the accident affects your daily life. Proper documentation is key to making sure no category of compensation is overlooked when you file a claim.

Economic Damages

Economic damages are measurable financial losses caused by the accident. These typically include:

- Medical expenses, including emergency care and future treatment

- Ongoing rehabilitation or long term care

- Lost wages or reduced earning capacity

- Costs to have your vehicle repaired or replaced

- Other property damage related to the accident

These losses are supported by bills, invoices, and employment records. Clear documentation helps ensure these costs are fully considered during negotiations.

Non Economic Damages

Non economic damages address the personal impact of an accident that does not come with a direct bill. These damages may include:

- Pain and suffering

- Emotional distress

- Loss of enjoyment of life

- Psychological effects such as anxiety or trauma

Although harder to calculate, non economic damages are often a significant part of fair compensation, especially when injuries affect daily functioning or long term wellbeing.

Special and Punitive Damages

In certain cases, additional damages may apply. Punitive damages may be awarded when the at fault party acted with extreme negligence or disregard for safety. These damages are meant to punish wrongful conduct and deter future suffered harm.

In fatal accidents, surviving family members may pursue wrongful death damages. These can include loss of financial support, funeral expenses, and the emotional impact of losing a loved one.

Why Fair Compensation Is Often Disputed

Insurance companies are businesses, and their goal is often to limit payouts. Even valid claims may face resistance during the claims process. Insurers may question the seriousness of injuries, point to gaps in medical treatment, or argue that damages are unrelated to the accident.

Social media activity can also be used against claimants. Posts taken out of context may be used to dispute injuries or reduce settlement value. Missing documentation or delayed treatment can weaken a claim further.

Negotiations are often complex, especially when multiple other parties are involved. This is why many people seek legal help to level the playing field. Proper preparation, consistent medical care, and careful communication can make the difference between a reduced payout and fair compensation.

Other claims you can recover damage from:

When You Should Hire an Experienced Car Accident Lawyer

Hiring an experienced car accident lawyer becomes critical when a road traffic accident leads to serious injuries, high medical costs, or disputes over fault. If you are facing mounting medical bills, lost income, or long term consequences such as pain and suffering, legal help can make all the difference in securing fair compensation.

An attorney is especially important when the other driver’s insurance company challenges liability, downplays injuries, or offers a quick settlement that does not reflect the true extent of your losses. Non economic damages such as emotional distress and loss of enjoyment of life are often undervalued without legal support. In wrongful death cases, legal representation (

specialist personal injury solicitors) is essential to protect the rights of surviving family members.

You should also consider hiring a lawyer if damages exceed policy limits, if multiple parties are involved, or if fault is disputed under comparative or contributory negligence rules. An experienced car accident attorney understands how to prove liability, navigate insurance thresholds, and protect your claim from costly mistakes.

Contact An Attorney

No Win, No Fee. Let the Best Road Traffic Accident Attorneys Fight for your Compensation!

How an Experienced Car Accident Lawyer Helps With Your Claim

An experienced car accident lawyer provides structure and strategy throughout the claims process. They ensure compliance with court rules and procedural deadlines, which is critical because failure to follow these rules can result in penalties or even dismissal of the case.

Under the Personal Injury Protocol, attorneys manage evidence collection, documentation, and communication with insurance companies. They gather medical records, police reports, witness statements, and proof of negligence to build a strong case. Lawyers also handle negotiations with insurance adjusters who are trained to minimize payouts.

Legal representation adds leverage. Insurers are more likely to take a claim seriously when an attorney is involved. Your lawyer also ensures that non economic damages are properly documented, including emotional distress and daily pain logs, helping pursue a settlement that reflects the full impact of the accident.

Common Mistakes That Can Hurt Your Accident Claim

Many valid accident claims are weakened by avoidable mistakes. Common errors include:

- Accepting the first settlement offer, which is often a low offer that does not cover long term costs

- Admitting fault at the scene or to insurance adjusters before liability is determined

- Delaying medical treatment, allowing insurers to argue injuries were not serious or were pre existing

- Posting on social media, where content may be used to dispute injury claims

- Missing filing deadlines, including insurance notification or court deadlines

To protect your claim, keep detailed records of medical bills, repair estimates, lost wages, and pain documentation. Avoid discussing the accident publicly and follow all reporting requirements closely.

Road Traffic Accident Claims and State Specific Rules

Road traffic accident claims vary significantly by state, particularly in how fault and compensation are handled. Some states follow contributory negligence rules, where a claimant may be barred from recovery if found even slightly at fault. Other states use comparative negligence systems, reducing compensation by the claimant’s percentage of fault.

Florida follows a comparative fault system and has specific PIP insurance rules. If damages exceed what PIP covers, auto accident victims may file a claim against the at fault driver’s insurance. In modified comparative fault states, recovery may be prohibited if a claimant is 51 percent or more at fault.

Insurance payouts are often capped by policy limits, even when damages exceed coverage. This makes early evidence gathering critical. Exchanging information, documenting the scene, collecting witness details, and obtaining a police report all help establish liability. Understanding state specific rules and acting quickly helps protect your right to pursue compensation.

Frequently Asked Questions About Road Traffic Accident Claims

Road traffic accident claims often raise urgent questions, especially when injuries, insurance deadlines, and compensation are involved. Below are clear answers to the most common concerns people have after an accident.

Should You File a Claim Immediately After an Accident?

Yes. You should file a claim as soon as possible after a road traffic accident. Most insurance policies require notification within 24 to 72 hours, and some require a formal insurance claim compensation within 30 days to qualify for coverage.

Filing early helps preserve evidence, supports your medical records, and prevents insurers from arguing that injuries or damage were unrelated to the accident. Delays can weaken your position and reduce compensation.

What Is the Maximum Compensation for a Road Traffic Accident?

There is no single maximum amount. Compensation depends on several factors, including the severity of injuries, medical expenses, lost income, property damage, and available insurance coverage.

Non economic damages such as pain and suffering or emotional distress may also apply. In some cases, compensation is limited by the at fault driver’s policy limits, even when total damages are higher.

How Much Does a Road Accident Fund Payout?

A road accident fund payout varies widely and depends on jurisdiction, injury severity, and financial losses. Some claims cover only medical costs and lost wages, while others include long term care, disability, or wrongful death damages.

The amount is influenced by medical documentation, proof of liability, and whether legal representation is involved.

What If the Other Driver Is Uninsured or Underinsured?

If the other driver lacks sufficient insurance, you may still recover compensation through your own uninsured or underinsured motorist coverage, if your policy includes it.

These claims follow a similar process but require careful documentation and timely filing. An attorney can help determine available options.

Can You Still File a Claim If You Were Partially at Fault?

In many states, yes. Comparative fault systems allow recovery even if you were partially at fault, though compensation may be reduced by your percentage of responsibility.

In contributory negligence states, however, any degree of fault may bar recovery. Determining prove fault early is critical in these cases.

Final Thoughts on Filing a Road Traffic Accident Claim

Filing a road traffic accident claim is about protecting your health, finances, and future stability. Early medical treatment, accurate documentation, and prompt reporting all play a critical role in securing fair compensation.

Insurance companies often aim to limit payouts, especially when injuries are serious or long term. Strong evidence and a clear understanding of your rights make a significant difference.

When injuries, medical costs, or liability issues are substantial, legal guidance can help navigate the claims process and protect you from costly mistakes. Taking action early gives you the best chance to recover damages and move forward with confidence.

Get Legal Help

No Win, No Fee. Let the Best Road Traffic Accident Attorneys Fight for your Compensation!