Does State Farm Homeowners Insurance Cover Asbestos?

Does State Farm homeowners insurance cover asbestos is a common question for homeowners facing asbestos related damage and potential financial loss. This page explains how asbestos related insurance disputes may create legal claim opportunities, not insurance advice. It focuses on coverage denials, exclusions, and situations where policyholders may have legal options. This content is for homeowners assessing whether they may qualify for an asbestos related claim.

State Farm Policy on Asbestos Abatement

Straight talk: State Farm isn’t your go-to for picking up the tab on asbestos removal. Why’s that, you ask? It’s because asbestos is tricky business—a.k.a. hazardous. The process of banishing this sneaky material from your home is neither cheap nor simple. That leaves you, the homeowner, hunting for Plan B or insurance specifically crafted to handle asbestos shenanigans.

Common Exclusions in Asbestos Claims

Here’s the thing with a lot of insurance policies, especially those handed out by the likes of State Farm—they come with no-help-here clauses for stuff like floods, earthquakes, and yeah, you guessed it, asbestos. The gritty truth is, removing asbestos isn’t seen as a “bam, surprise!” catastrophe but rather as a planned fix. This is why insurers are less inclined to cover it under your standard home insurance.

If you’ve had a heart-stopping moment discovering asbestos in your beloved abode and need to evict it, grab that phone. Call up your insurer, and quiz them on what, if anything, they can do beyond saying “no.” It’s all about knowing where you stand.

There’s a decent chance that scenarios involving asbestos won’t fall under your policy’s umbrella. But don’t despair—there are special insurance plans, or even financial lifelines out there, ready to tackle such obnoxious disturbances.

For more clarity—and let’s be honest, who couldn’t use that when insurance jargon is involved—ring up a State Farm rep or your insurance whisperer. These folks can shed some light on handling the asbestos dilemma or map out alternatives that suit your needs without breaking the bank.

Table of Contents:

Why Asbestos Often Leads to Insurance Coverage Disputes

Asbestos is referenced here only as a material involved in insurance claims and property damage disputes. Picture it like a super tough and heat-proof material that just seems to fit right into these industries’ needs.

Asbestos got popular because it’s strong and doesn’t burn easily. You’d find it in loads of products, everything from materials you build with to those bits in brakes and clutches of cars. Concerns related to asbestos are relevant in this context because they often trigger insurance exclusions and coverage denials.

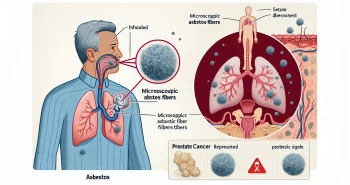

Insurance claims involving asbestos frequently arise after renovation, damage, or inspection reveals its presence. And if we breathe those in? That’s bad news. Health discussions are outside the scope of this page and are not used to determine insurance or legal eligibility.

The big worry about asbestos is its cancer-causing nature. You won’t feel sick right away—nope, it can take years before symptoms show up. Because it’s a sneaky threat to our health, there’s been a big push to cut down on how much we’re around it and handle it like the hazardous stuff it is.

It’s important to get a grip on both what asbestos is and how it can mess with our health. More knowledge equals more power to make smart choices about this stuff lurking around us and to keep ourselves and our families out of harm’s way. Doing a bit of homework on asbestos could be the difference maker in staying safe.

Does Homeowners Insurance Cover Asbestos Removal?

Dealing with the nitty-gritty of insurance related to asbestos removal might feel like solving a riddle wrapped in a mystery. Figuring out when your insurance might step in for asbestos-related expenses can save you quite the headache. Let’s sort out the situations where your insurance might actually have your back on this, and when you’d be left holding the bill.

When Does Home Insurance Cover Asbestos?

Most folks who have a typical homeowners insurance policy will find it’s there for those unexpected, “oops” moments. So, if suddenly something wild like a busted pipe or an unexpected storm causes an asbestos scare, your policy might just help with the cleanup tab. That being said, what they cover can go up and down like a rollercoaster depending on the fine print in your policy. It’s always a smart play to know those details.

When Is Asbestos Removal Not Covered?

Now, here’s where you’ll need to put on your thinking cap. Homeowners insurance doesn’t usually chip in for the usual wear and tear of your place, including dealing with pesky asbestos. If that stuff started coming apart just because it got old, well, that’s on you. Plus, if it turns out that asbestos was lurking around as a pre-existing issue you could’ve handled with some regular TLC, then insurance might turn a blind eye towards funding the fix.

Getting a handle on when your homeowners insurance steps up for asbestos removal is like having a cheat code to this particular challenge. Make it a point to sit down with your insurance policy and, if needed, have a chat with someone in the know like a State Farm rep to really nail down what your coverage is all about. And if it turns out your insurance isn’t playing ball, you might wanna think about other ways to handle the asbestos costs.

Does State Farm Homeowners Insurance Cover Asbestos?

When you’re dealing with the nitty-gritty of State Farm homeowners insurance, figuring out how it handles asbestos issues is key. We’re talking asbestos abatement and those dreaded exclusions you’ll want to know about.

State Farm Policy on Asbestos Abatement

State Farm’s all about covering your back with various risks, but asbestos? That’s a whole other ball game. Generally, they play it safe—coverage might be there, but with strings attached. To really know if you’ve got the green light, you’ll need to dig into your policy’s terms and conditions. That means sitting down with your stack of papers or a mug of coffee and getting cozy with your homeowners insurance details.

Common Exclusions in Asbestos Claims

Now, here’s the kicker—exclusions. No one likes surprises, especially when it comes to finding out what your insurance won’t cover. Like many other insurers, State Farm might say no thanks to asbestos claims that are due to things not covered by your policy. It’s a bit like playing a game where the rules change depending on your move.

For most asbestos claims, if the damage comes from something outside their list, you’re basically on your own. Understanding this is huge, ’cause if there’s a gray area, it’s your job to clear it up. Think you might be in a tight spot with asbestos coverage? It’s a good idea to chat up a State Farm representative who can lay it all out for you.

But let’s say you’re stuck in an asbestos pickle—proactivity is your secret weapon. Know your coverage inside and out by poring over the fine print and maybe ringing up State Farm for a good ol’ chat. And if you’re not liking what you hear, there are options. You can hunt for asbestos-specific insurance that might offer you the peace of mind you’re craving.

In a bind? There are more ways to skin a cat when it comes to funding asbestos removal. Look into government grants, check out asbestos abatement programs, or see if a home renovation loan can give you a hand.

Lastly, if asbestos exposure has got you in legal hot water, or you’re about to hit up a claim, you gotta know your stuff about timelines and processes. Legal advice could be your best friend here. Knowing how to poke and prod the right spots can lead you to compensation, or at least some semblance of justice for asbestos-related woes.

How to Check If Your Policy Covers Asbestos

You’ll want to get to the nitty-gritty of your homeowners insurance to see if those pesky asbestos issues are covered. Here’s how you can do just that, without feeling like you’re reading stereo instructions.

Reviewing Your Homeowners Insurance Policy

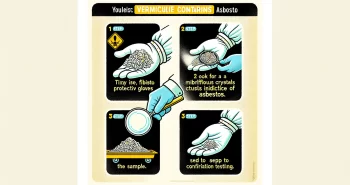

First up, grab your insurance policy document. It’s not exactly a page-turner, but it’s got the answers you need. You’ll want to zoom in on sections dealing with property damage, liability coverage, and those pesky exclusions, especially anything that sounds like it might apply to asbestos. Keep an eye out for bits about coverage limits, deductibles, and the exact situations where asbestos-related damage might leave you hanging.

Your policy’s got the lowdown on what exactly your insurer is willing to pay for—it’s all there in black and white, maybe buried in some lawyer-speak about asbestos removal or abatement. If it’s got you more confused than a bat at a disco, don’t sweat it. Hit up your insurance agent for the 411.

Chattin’ with a State Farm Rep

If you’ve got that good ol’ State Farm coverage, it can’t hurt to have a chinwag with one of their reps. They’re the ones who know your policy inside and out and can tell you how far their coverage stretches when it comes to asbestos. Ask them about any exclusions—you don’t want any nasty surprises—and see if there’s a way to bolster your coverage.

State Farm folks can decode the mystery that is your policy, so don’t be shy about asking all the questions. Have your policy number handy, tell them what’s bugging you, and let them fill you in about where you stand with asbestos risks and what your insurance is actually gonna do about it.

Sniffing Out Other Insurance Options for Asbestos Removal

Okay, maybe your current policy is giving you the cold shoulder when it comes to asbestos. Don’t panic. There are specialized policies out there made just for this drama. It’s worth checking out insurance specifically meant for environmental troubles—the kind that talks about asbestos like it’s no big deal.

These alternative options can include standalone environmental liability insurance or pollution liability coverage. These bad boys are designed to help you not get left holding the bag if you gotta deal with asbestos claims and cleanup. Do some legwork — see what different insurers are offering, compare policy perks, and find something that won’t break the bank but has your back.

By diving into your insurance policy, chatting with a State Farm pro, and sussing out other insurance options, you’ll know exactly where you stand on asbestos coverage. That way, you’ve got all the info you need to keep your home, and your wallet, safe from lurking asbestos surprises.

What to Do If Your Insurance Won’t Cover Asbestos

Oof, finding out your insurance won’t pay for asbestos removal? That’s a pickle. Still, you ain’t out of options yet—there’s help out there to tackle those pesky asbestos costs and keep health worries at bay.

Can You Get Financial Assistance for Asbestos Removal?

If your homeowner’s insurance is giving you the cold shoulder, don’t despair. There are organizations and agencies that toss grants and aid to folks dealing with asbestos headaches.

Government Grants and Asbestos Abatement Programs

Sometimes Uncle Sam has your back with grants and programs to help those hit by asbestos woes. They can chip in for testing, hauling away, and making sure things are clean as a whistle. Do yourself a favor and poke around with local and federal folks to see what might be up for grabs near you.

Home Renovation Loans for Asbestos Removal

Home renovation loans could be your ticket, especially ones aimed straight at asbestos clearing. They can help cover the heavy lifting and ensure your abode is safe for everyone under your roof. So, give a holler to banks or maybe even government loan programs to sniff around this funding path.

When your insurance is giving you the silent treatment, grants, abatement help, or renovation loans can swoop in for a rescue. Hunting down these alternatives means you’re taking charge of the asbestos mess, protecting your nest, and looking out for the family.

Asbestos Claims, Liability, and Legal Rights

Asbestos exposure is something you don’t wanna mess around with—it’s sneaky, and understanding its risks along with your rights to compensation can be tricky but crucial.

What to Do If Asbestos Leads to an Insurance Dispute

Feeling off or had a brush with asbestos? Well, the first move is hitting up a doc who knows the ropes on this stuff. Even if you’re not coughing up anything weird right now, asbestos is like that one horror movie villain. It waits until the last minute. And guess what? That villain ain’t gonna be your friend later in life.

Document when and how asbestos was identified in your property and how the insurer responded. Catch stuff early, and you might just dodge a bullet.

How Long Do You Have to File an Asbestos Claim?

Got a ticking clock on filing those asbestos claims—and which clock is yours depends on where you live. It’s all about when you got sick and when you figured out you got sick.

Usually, you can file one to five years after knowing you’re dealing with asbestos-related woes. Don’t sleep on this. Go chat with a lawyer who eats asbestos cases for breakfast—they’ll fill you in on your deadlines.

Filing a Claim for Asbestos-Related Compensation

If a doc gives you the nod on an asbestos-related sickness, you might get some cash for all the mess it caused. We’re talking hospitalized days, paychecks that never saw the light of day, and just plain hurt.

To get rolling, you need a stack of evidence. Your dentist might not cut it, but a lawyer with asbestos experience will. They’ll help you through the wild legal forest, holding your hand and nearly strong-arming insurers to cough up what they owe you.

Knowing how to tackle asbestos, aware of your claim deadline, and landing a sharp lawyer could put you on the track of compensation and justice. If asbestos has turned your world upside down, don’t just sit and watch—stand up, demand your dues, and aim for what you deserve.