Collision Insurance vs Legal Claims Explained

If you have been in a recent car accident, understanding what is the difference between comprehensive and collision insurance is crucial to ensure you get the compensation you deserve. Don’t let confusing insurance terms hold you back get a free case review today with Legal Claim Assistant. Our experts will help you navigate your policy, determine which coverage applies, and connect you with experienced attorneys ready to fight for your full compensation. Click the button now to start your free, no-obligation case review and take the first step toward getting the help you need.

No Win, No Fee. Let the Best Motor Vehicle Accident Attorneys Fight for your Compensation!

Table of Contents:

Understanding Comprehensive Auto Insurance

Comprehensive auto insurance coverage pays for vehicle damage to your car that is not caused by a collision with another vehicle or a stationary object. A simple way to remember it is “everything except a typical crash.” If something happens to your car while it is parked or in a situation that does not involve impact with another car or object, comprehensive is usually what steps in.

Common non collision incidents covered under comprehensive insurance include theft, vandalism, fire, hail, falling trees or debris, flood, and animal impacts such as hitting a deer. If your windshield is cracked by a rock or broken in a storm, that often falls under comprehensive as well. Each policy has limits and exclusions, so we always suggest reading your declarations page and calling your insurer to confirm how they classify specific damage.

Comprehensive coverage generally costs less than collision coverage but includes a deductible that affects your premium costs. Both comprehensive and collision insurance typically require separate deductibles. Comprehensive coverage is optional in many states, but if you have a car loan or lease, your lender will usually require it. Both comprehensive and collision insurance are typically required by lenders if you finance or lease your vehicle, and lenders typically require both comprehensive and collision coverage until the vehicle is paid off. Liability insurance is the only coverage legally required in many states, but comprehensive and collision may be required by lenders for financed or leased vehicles.

If you own your vehicle outright and could afford to repair or replace it in the event it was stolen or damaged, you could avoid the cost of comprehensive insurance altogether. However, you may want to consider comprehensive coverage if you cannot afford to pay out of pocket for repairs or replacement of your vehicle. Drivers who do not carry comprehensive insurance may have to pay for vehicle damage, including vandalism and theft.

Comprehensive insurance helps pay to replace or repair your vehicle if it’s stolen or damaged in an incident that’s not a collision. Comprehensive coverage protects against non-collision incidents such as theft, vandalism, and natural disasters. Comprehensive coverage can help safeguard from unpredictable and non-driving-related incidents. It covers damages from unforeseen events like fire, theft, vandalism, and weather-related incidents. If you’re financing or leasing your car, your lender will likely require comprehensive coverage, often until the vehicle is paid off.

Understanding Collision Car Insurance

Collision coverage applies when your car is damaged because your car hits something or something hits your car. If you are wondering what does collision mean, it is essentially physical impact. That impact can be with another vehicle, a guardrail, a pole, a building, a telephone pole, or even a rollover where your car rolls without hitting another object.

If you are in a rear end collision at a stoplight or a head on collision on a two lane road, collision coverage is usually the part of your policy that covers damage to your car resulting from repairs to your own vehicle, subject to your deductible. Collision also applies in single vehicle crashes, for example if you slide on ice and hit a tree or a fence. The focus is on the impact event rather than the broader cause, such as bad weather or a sudden medical emergency.

Like comprehensive, collision coverage is often required by lenders and it also pays up to the actual cash value of the vehicle if it is a total loss. Collision coverage is required by lenders if you finance or lease a vehicle. Collision coverage helps cover damage from accidents involving other cars or objects. Collision coverage can help in driving-related incidents, while comprehensive coverage can help with unexpected non-driving damages.

What is the Difference Between Comprehensive and Collision Insurance

Both coverages protect your own car, not someone else’s, and both usually have deductibles and limits. The practical difference lies in how the damage happens. Collision insurance covers damage caused by impact with another vehicle or stationary object, including a vehicle caused by striking a telephone pole. Comprehensive insurance covers damage caused by non collision incidents such as theft, weather, or animals.

In a typical crash, such as a rear end collision settlement examples situation where one driver hits another, collision coverage usually applies for the driver whose own insurer is paying to fix their vehicle. For the not at fault driver, the at fault driver’s liability insurance should pay first. Comprehensive usually comes into play when no one is really “at fault” in the same way, such as when a tree limb falls on a parked car during a storm.

This distinction matters for both cost and legal strategy. Collision claims often raise questions about who caused the crash, potential injuries, and whether you might also have a bodily injury claim for medical expenses. Comprehensive claims tend to be more straightforward from a fault perspective, but disputes can arise over the value of your vehicle or whether the event really counts as non collision. When we review a case, we look at which coverage was used, how fault was assigned, and whether there is room to pursue a separate legal claim for your injuries.

In simple terms, collision is “your car hits something,” comprehensive is “something happened to your car.”

Key Situations Where Collision Coverage Is Essential

Collision coverage is essential any time your car is damaged in an impact, especially when fault is unclear or when the at fault driver’s insurer is delaying. After a crash, your own collision coverage can often pay to repair or replace your car more quickly, then your insurer may seek reimbursement from the other driver’s company.

We see this play out often in not at fault collision claim scenarios. For example, if you are injured in a rear end collision but the other driver is disputing what happened, using your collision coverage can get your car back on the road sooner. Separately, you may still have a personal injury claim for medical bills, lost wages, and pain and suffering.

Collision coverage can also be critical in more severe head on collision events or multi car pileups. In these crashes, fault can be shared between several drivers, and insurers may argue over who pays what portion of the damage. If your own coverage is in place, you have a clearer path to vehicle repair or replacement while your attorney focuses on the injury claims against the responsible parties.

Key Situations Where Comprehensive Coverage Is Essential

Comprehensive coverage matters any time your car is at risk from events you cannot control and that do not involve a traditional crash. If you live in an area with frequent hail storms, wildfires, floods, or high theft rates, comprehensive can protect you from large repair or total loss bills that would otherwise come out of pocket.

For example, if a thief steals your car and it is later found with heavy damage, comprehensive is usually what pays. If a windstorm sends debris into your parked vehicle or a tree branch crashes through your windshield, that is typically comprehensive as well. Even hitting an animal, like a deer darting across a dark highway, is usually classified under comprehensive, not collision, by most insurers.

From a legal perspective, comprehensive claims do not usually involve another at fault driver. However, that does not mean there is never another responsible party. If a property owner neglected a known hazard that damaged your vehicle, or if a business failed to maintain a parking structure, there may be a separate claim. When we review your situation, we look beyond the insurance label and focus on whether someone’s negligence contributed to what happened.

No Win, No Fee. Let the Best Motor Vehicle Accident Attorneys Fight for your Compensation!

How Comprehensive and Collision Coverage Work Together

Comprehensive and collision coverage are often sold together in what most insurers call “full coverage insurance,” along with liability insurance and sometimes medical payments or personal injury protection. They work side by side to protect your vehicle in almost any scenario, whether you are driving or your car is parked.

In some incidents, both coverages may be considered before the insurer decides which applies. For example, if you lose control while swerving to avoid an animal and end up hitting a fence, the damage from striking the animal itself would fall under comprehensive, while the impact with the fence would be collision. Your insurer will use its internal rules to classify the claim, and that choice affects what deductible you pay.

When you contact us after a crash, we look at the entire coverage picture. If you are dealing with a car collision lawyer or considering hiring one, we want to ensure that all applicable coverages are used in your favor. That includes your collision and comprehensive benefits, the at fault driver’s liability coverage, and any uninsured or underinsured motorist coverage you carry.

Real-Life Case Studies: When Insurance Type Changed the Outcome

We often speak with drivers who assumed they had “full coverage insurance” but then discovered that a specific type of loss was treated differently than they expected. The type of insurance involved can change not only how the car is repaired, but also how the legal side of the claim unfolds.

Consider a passenger injured in a rear end collision on the freeway. The driver’s collision coverage paid to repair the vehicle quickly. However, the passenger’s injuries led to ongoing back pain and months of physical therapy. While the collision claim handled the car, a separate injury claim was needed against the at fault driver, and our role was to help the passenger connect with a rear end collision attorney to pursue compensation for medical expenses, lost work time, and long term symptoms similar to what people ask in how long does back pain last after a rear end collision.

In another case, a driver who owned their vehicle outright woke up to find their car crushed by a fallen tree after a storm. Comprehensive coverage paid to total the vehicle, but the payout offer seemed low compared to actual replacement prices in the local market. Because there was no other driver at fault, this was not a standard injury claim. However, if the vehicle caused damage to a nearby telephone pole, there may be additional liability coverage considerations. By understanding how comprehensive value is calculated and documenting higher comparable prices, it was possible to challenge the offer and secure a better settlement. The insurance type shaped both the strategy and the outcome.

Cost Considerations: Choosing the Right Coverage for Your Car

Choosing how much comprehensive and collision coverage to carry is a financial decision that depends on your car’s value, your budget, and your risk tolerance. Newer or financed vehicles usually make these coverages more important, because repair costs and payoff amounts are higher. If you drive in heavy traffic where rear end collision incidents are common, or you commute long distances at highway speeds where a truck collision attorney might see many severe cases, collision coverage can be crucial.

The Insurance Information Institute suggests that you take the amount you’d pay in one year for comprehensive and collision coverage and multiply that number by 10 to determine if it’s cost-effective. For older vehicles with a low market value, some drivers decide that the annual cost of premiums and deductibles is not worth it.

Premiums typically rise as you choose lower deductibles or higher coverage limits. If your car would be difficult for you to repair or replace out of pocket, maintaining both comprehensive and collision is often wise.

On the injury side, remember that vehicle coverage does not pay for your pain, your lost wages, or the long recovery that often follows a crash. Those losses are usually pursued through a personal injury claim against the at fault driver, sometimes with support from their auto collision law firm and yours. When we assess your situation, we consider both the property damage coverage you used and the separate legal options that may be available for your injuries.

Common Mistakes Drivers Make with Collision and Comprehensive Insurance

One common mistake is assuming that “full coverage” automatically means every type of loss is covered at a level that makes you whole. Policies vary, and some drivers find out too late that their deductibles are higher than they thought or that rental car coverage is limited. Another mistake is dropping comprehensive or collision coverage too early when a vehicle still has significant value, then facing a total loss with no help.

Drivers also sometimes file claims under the wrong coverage or accept an insurer’s initial classification without question. For example, damage that looks like “wear and tear” at first glance may actually come from a covered incident like a minor impact or falling object. Similarly, people who are clearly not at fault in a crash may choose to pay out of pocket rather than use collision coverage, because they worry about premium increases, then lose leverage in later negotiations.

Finally, many injured people assume that if their car was fixed and medical bills were paid by insurance, there is nothing more they can do. In reality, if you were hurt in a crash and the other driver was at fault, you may be entitled to additional compensation for long term effects. Settlement questions such as average rear end collision settlement or how long does a rear-end collision settlement take are separate from the collision or comprehensive claim on your car.

How Legal Claim Assistant Can Help You Maximize Your Insurance Claims

When you contact Legal Claim Assistant after a crash, our goal is to help you understand where insurance ends and your legal rights begin. We look at the whole picture, from what coverage applied to your vehicle to whether you may have a claim for injuries, lost income, or long term impacts that are not fully covered by insurance.

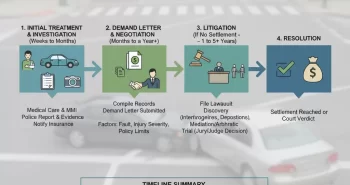

We help you make sense of your policy language, which can be especially important if you are unsure whether your loss should be treated as collision or comprehensive. If you were injured, we connect you with the right attorney for a free case review, whether you were in a simple fender bender, a serious head on collision lawsuit, or a complex multi vehicle crash. Those attorneys regularly guide clients through what to do next, including detailed steps like what to do after a car collision or the more specific what to do after a rear end collision.

We also understand that timing matters. Most of the people we help were injured within the last 12 months, sought medical care within the first two weeks, and are now trying to figure out their options. If that sounds like your situation, we can help you answer the key questions: which insurance should pay, whether you qualify for additional compensation, and which legal path gives you the best chance to move forward with less financial stress.

No Win, No Fee. Let the Best Motor Vehicle Accident Attorneys Fight for your Compensation!